Billing & Pricing Details

Pricing: How is the data migration price calculated?

The pricing for your data migration is determined by various factors:

- Number of Records: The quantity of records on your source platform, including tickets, companies, changes, problems, contacts, agents, and groups.

- Knowledge Base Content: The number of records in your knowledge base, such as articles, categories, and folders.

- Source and Target Platforms: The platforms you're migrating from and to.

- Selected Pre-built Custom Options: Any additional options or customizations chosen for your migration process.

- Chosen Support Plan: The level of support plan you select, which may vary based on the features and support offered.

- Automated Migration Availability: Whether automated migration is supported for your specific source and target platforms.

- Customization by Development Team: Any specific customization of your migration process performed by our development team.

It's essential to note that pricing doesn't increase linearly with data volume. Also, certain elements of the migration, such as notes, attachments, ticket custom fields, and replies, are transferred free of charge.

To calculate your data migration price accurately, the recommended approach is to set up a Free Demo Migration. This allows you to assess the migration process, explore available options, and receive a tailored pricing estimate based on your unique migration requirements.

What is customization? How is a custom work price calculated?

Customization refers to any modification made to the default automated migration process to meet specific requirements that cannot be achieved automatically. This may include tasks such as data filtering, restructuring data, adding extra tags to tickets, or transforming field types.

Our technical team is capable of implementing custom code to address these needs and ensure a tailored data migration.

Custom work is typically billed separately from the cost of automated data migration. The price of custom work is determined based on the complexity and scope of the customization required.

To inquire about customization or adjustments to your data migration, please contact our team at contact@help-desk-migration.com. Our sales representatives will provide you with further information and pricing details based on your specific requirements.

How much does data migration for an unsupported platform cost?

The cost of data migration for an unsupported platform varies depending on the complexity of developing and adding support for that specific platform. As such, there isn't a fixed price for migrations to or from platforms not currently supported by our service.

When you request an automated data migration to or from an unsupported platform, our sales representative will reach out to you. They will require access to your unsupported platform to assess the complexity of the migration and generate a customized data migration quote.

Once the assessment is complete, our team will provide you with a detailed quote based on the specific requirements of your migration project. This quote will reflect the efforts required to develop and implement support for the unsupported platform, ensuring a smooth and successful data migration process.

What are the paid options? How much do the pre-built custom options cost?

Paid options are the pre-built customizations available in the mapping stage. Those options include

| Paid Option | Supported for Platforms |

|---|---|

| add a new tag to the migrated tickets | importing to Jira Service Management, HelpScout, Freshservice, Gorgias, Zoho Desk, Re:amaze, Intercom, Kayako, ServiceNow, Freshdesk, Zendesk |

| migrate inline images as attachments | moving from Jira Service Management, HelpScout, Freshservice, Gorgias, Zoho Desk, Re:amaze, Kayako, ServiceNow, HubSpot Service Hub, Freshdesk |

| skip attachments | moving from Jira Service Management, HelpScout, Freshservice, Gorgias, Zoho Desk, Re:amaze, Intercom, Kayako, ServiceNow, HubSpot Service Hub, Freshdesk, Zendesk |

| migrate call recordings as attachments | from Zendesk to any other help desk platform |

| migrate content translations (aka language versions of knowledge base articles) | Zendesk, Salesforce Service Cloud, Intercom, Freshdesk - each platform can be either like Source or Target |

| migrate side conversation | Merging two Zendesk instances, your ticket side conversations are imported as side conversations. If you migrate Zendesk side conversations will be migrated as private comments |

You can get the price after you’ve done a Free Demo Migration.

What are the Support Plans?

The Help Desk Migration service offers three support plans aiming to provide an outstanding data migration experience:

- Standard is free of charge

- Premium starts at $200

- Signature starts at $500

More details about each support plan you can find here: Support packages explained.

Support packages explained: What is it and why do you need it?

Our migration service aims to enhance your data migration experience with tailored support packages. We understand that SMBs or business consulting have different migration needs from multinational enterprises. Hence, we offer diverse support services to meet your specific requirements.

How many hours during a week does our help team work?

Help Desk Migration’s support agents are available

- on weekdays (Monday to Friday), from 8 am to 12 am (UTC+2 or UTC+3)*

- on weekends (Saturday & Sunday), from 11 am to 1 pm and from 6 pm to 8 pm (UTC+2 or UTC+3)*

*Due to daylight saving time, the Support Center operates on:

- UTC+3: from Sunday, Mar 31, 2024 to Sunday, Oct 27, 2024

- UTC+2: from Sunday, Oct 27, 2024 to Sunday, Mar 30, 2025

What does Standard plan include?

The Standard plan delivers basic features that help you accomplish what you set out to do. This plan includes support from our team 9/5 via email, phone & chat during the regular response time stated in our SLA (i.e., response time within 24 hours); skipped/failed records check and migration. It is free and available to anyone who signs up.

What does Premium Plan include?

The Premium plan is a perfect fit for those customers who have a larger volume of records and specific requirements for data mapping. Within this support plan, we teamed up 16/5 support on weekdays and 4 hours on weekends, marked as high priority and responded to by our senior data migration experts. They have hundreds of successful data migrations under their belt. Another advantage of this plan is the option to re-migrate your data within 5 (days).

Key benefits and details

- Extended Support Hours: Enjoy 16/5 support via Email, Phone & Chat on weekdays and 4 hours of support via Email on weekends. Responses are provided promptly, ensuring assistance beyond standard SLA commitments. On weekends (Saturday and Sunday), expect replies within 6 hours.

- High Priority Response: Queries receive high priority, ensuring faster responses from our support agents.

- Dedicated Weekend Support Team: Premium plan subscribers benefit from support by senior team representatives experienced in successful data migrations. Expert assistance is available on weekends for guidance and troubleshooting.

- Data Re-migration: Within 5 days, re-migrate data for changes such as mapping adjustments, custom field modifications, tag additions, or agent mapping changes. This feature allows two migrations: one as a sandbox and the second for production.

- Time Frame for Re-migration: Re-migrate data within five days after completing the Full Data Migration. After this period, Demo and Full Data Migrations are automatically archived in compliance with our security policy.

What does Signature Plan Include?

The Signature plan is packed with options to meet your unique requirements. The service package delivers 16/5 support on weekdays, 4 hours on weekends, and urgent response within 2 (two) hours after submitting your request.

To give you even more control over the process, you get

- assigned a dedicated tech support team that would steward your data migration during weekends or/and holidays

- data re-migration within ten (10) days after the Full Data Migration has been completed

- Delta migration within ten (10) days after the Full Data Migration has been completed

Key benefits and details

- Extended Support Hours: Enjoy 16/5 support via Email, Phone & Chat on weekdays and 4 hours of support via Email on weekends, surpassing standard SLA business hours. Weekend responses are guaranteed within 6 hours.

- Highest Priority Response: Queries receive top priority, ensuring immediate attention from our support agents.

- Dedicated Tech Support: Your account manager and tech team are available during weekends and holidays to assist with your data migration.

- Data Re-migration: Within 10 days of Full Data Migration completion, re-run migration to adjust configurations as needed to align with your business requirements.

- Interval Migration: Pause migration during the workweek and resume on weekends or as per your scheduling needs, minimizing customer service lags or downtime.

- Delta Migration: Available exclusively in our Signature plan, migrate updated or new records without service downtime, preventing duplicates or data inconsistencies.

- Skipped/Failed Records Check and Migration: Address inactive employees, mandatory fields discrepancies, or failed record transfers by requesting a check and finding solutions for successful migration to your destination platform.

Support service details

The support team:

- Assists in connecting your source and target platforms.

- Aids in configuring records mapping.

- Guides you through setting up Free Demo Migration and Full Data Migration.

- Assists in identifying and resolving customization requirements, such as filtering records, managing custom fields, and arranging off-shore data migration.

- Provides guidance on customizing the migration process between selected platforms.

- Offers consultation on destination platform options.

- Consults on planning and scheduling your data migration project to align with your business needs.

- Assists in planning scheduled data migration.

The tech team:

- Customizes and enhances your migration process, seeking optimal solutions for seamless data transfer.

- Services available in Custom Data Migration or the Signature support plan.

Support packages pricing

- Standard is free of charge

- Premium starts at $200

- Signature starts at $500

Note: Note: The final cost of Premium and Signature may vary based on the number of your records. For an accurate price calculation, including support packages, we recommend running a Free Demo Migration. Upon completion, you'll receive a detailed price breakdown.

What payment methods available?

The Help Desk Migration service uses PayProGlobal for payment processing. PayPro Global Inc., is an authorized reseller of software, SaaS and digital goods, ffering payment processing solutions worldwide from its base in Canada. As per US IRS regulations non-US business entities are required to complete a W-8BEN-E form instead of W-9. Download PayPro Global W-8BEN-E form here.

To track your order, visit the Find Your PayPro Global order page.

Payment options available:

- Credit card. Accepts all major credit cards including Visa, MasterCard, Maestro, American Express, JCB, and Discover Bank. Note that currency exchange fees may apply for payments in currencies other than USD.

- PayPal. Select PayPal as your payment method upon following the payment link.

- Wire Transfer. Choose wire transfer as your payment method through the Migration Wizard's payment link. Contact us to receive the invoice. Make payments in advance or plan extra time, as it may take up to 10 days for payment processing. Migration begins upon receipt of payment on our end.

Is Help Desk Migration a one-time payment or subscription-based service?

Help Desk Migration operates on a one-time payment basis. No separate app price, pay only for migration.

- No hidden fees.

- No subscriptions.

- Run a Free Demo Migration to test our service before committing to a full payment.

Important note: Multiple migrations will be billed separately. For more details on pricing, refer to our pricing page.

Is there a free option for a small volume of data?

There isn't a completely free option available. Automated migrations pricing is varying based on the number of records in your help desk.

You can estimate your migration price and obtain an exact record count in your target help desk by running a Free Demo Migration.

For non-profit organizations, please contact our team to inquire about discounts.

Can I get an invoice?

Here's how you can obtain an invoice:

- After making the payment, please check your email. An invoice should be sent automatically to the email address provided during the payment process.

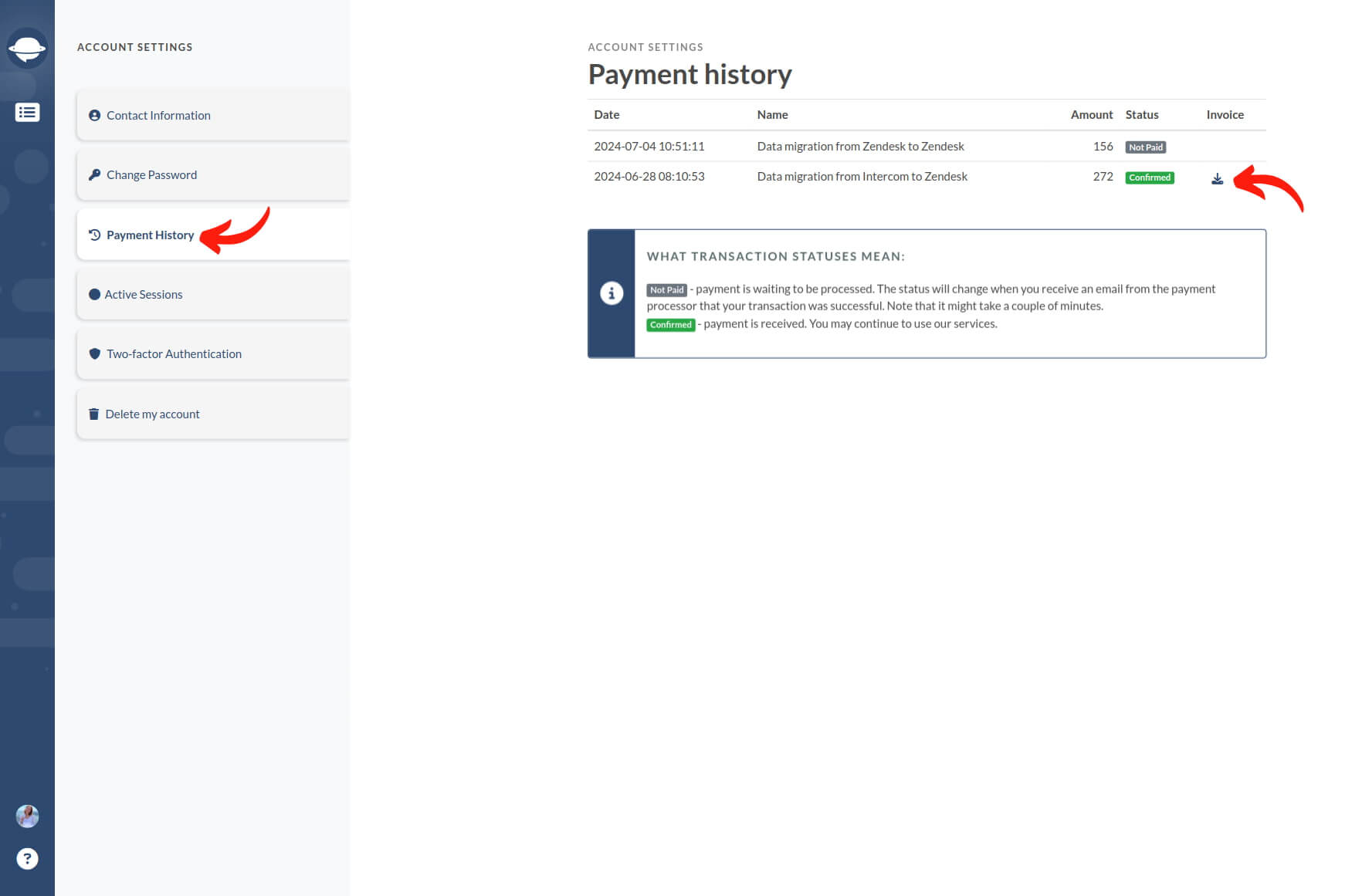

- If you can't locate the invoice in your inbox, you can download it from your Migration Wizard profile by following these steps:

− Click on your profile icon located in the bottom left corner. And go to Account Settings and select Payment History.

− Click on the Download button to retrieve the invoice for your paid migration.

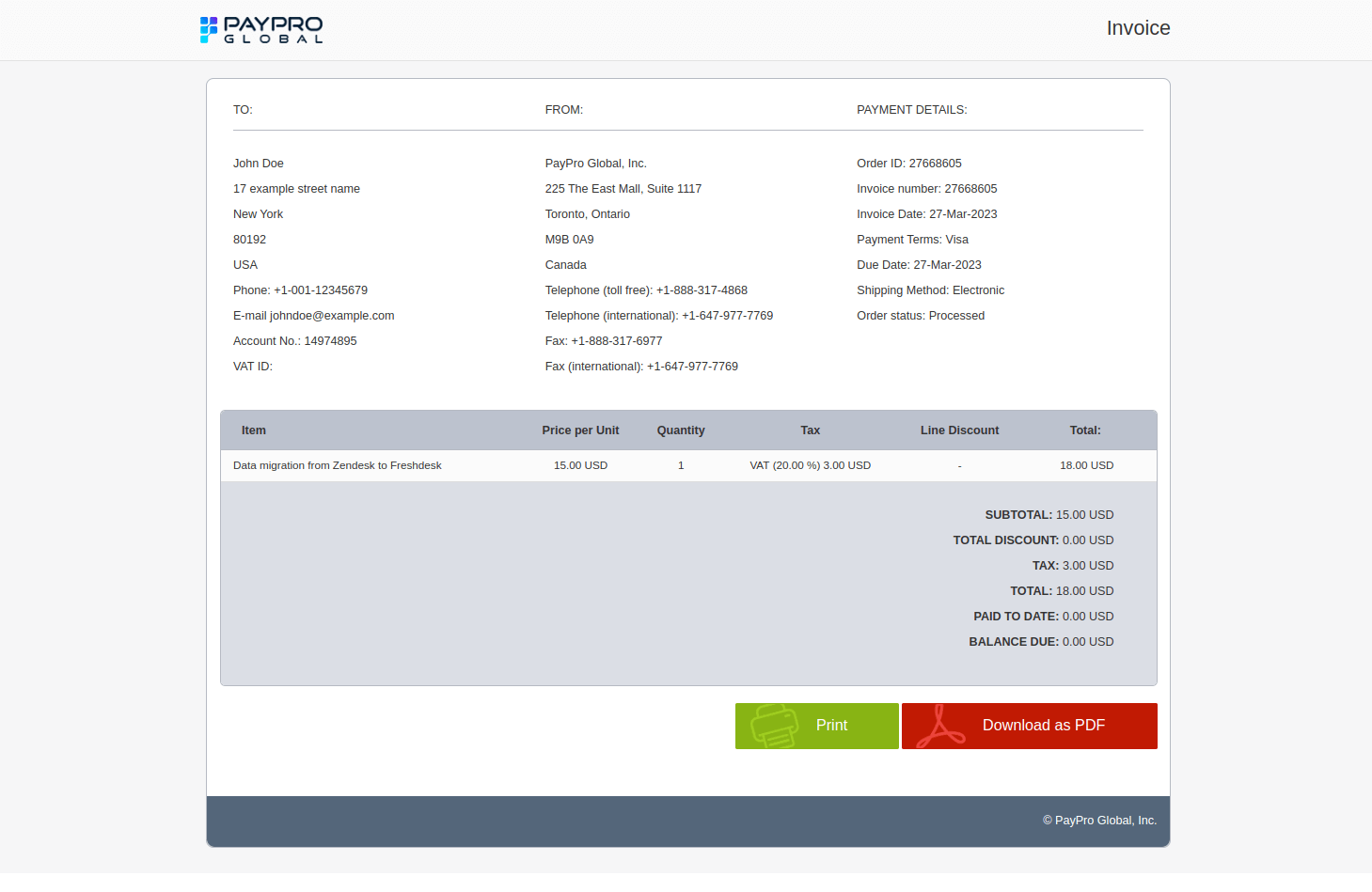

You can view a sample invoice below:

How to Avoid the VAT Charge?

To avoid the VAT charge:

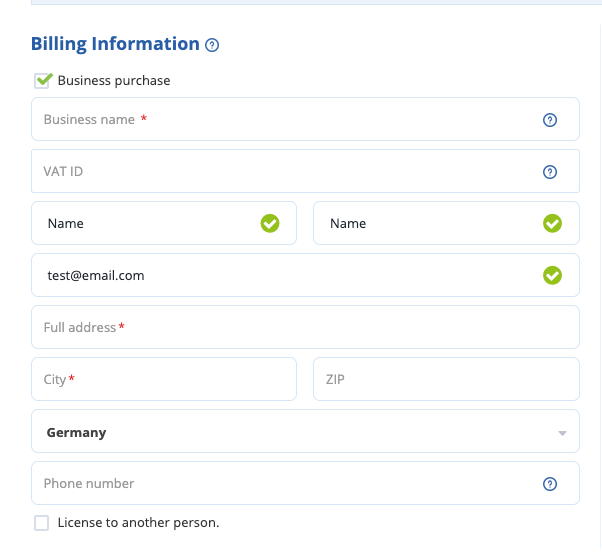

1. If you are a business with a valid VAT ID, you can bypass VAT by:

- Selecting "Business purchase" on the PayProGlobal payment page.

- Entering your VAT ID in the appropriate field.

2. If you've already made the payment and need a VAT refund:

- Email to support@payproglobal.com with your order ID and VAT ID.

- You'll be refunded the tax amount.

PayProGlobal may not have tax regulations for the country of your payment, resulting in non-refundable tax amounts.

To rectify this, send your TAX/VAT Registration Certificate to support@payproglobal.com for validation, and you'll be contacted accordingly.